Trial Balance is prepared to know the arithmetical accuracy of books of accounts. After that, annual or final accounts are prepared to know the financial position of the business. Final accounts include TradingA/c, Profit & Loss A/c, & Balance sheet Trading A/c, is prepared to know the net profit or the net loss & Balance Sheet is a statement prepared to know the financial position of the business.

For all of this you must know the Important Adjustment to prepare Balance sheet of Accounts.

Closing stock

|

| Closing stock Adjustment for Std 11 &12 |

|

| Unpaid exp./outstanding expenses/ expenses yet to be paid Adjustment for std 11 &12 |

Prepaid expenses

|

| Prepaid expenses Adjustment for std 11 & 12 |

|

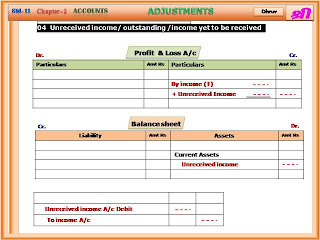

| Unreceived income/ outstanding /income yet to be received Adjustments for std 11 &12 |

|

| Pre-received income adjustment for std 11 & 12 |

|

| Interest on capital Adjustments for std 11 & 12 |

|

| Interest on drawings Adjustments for std 11 & 12 |

|

| Depreciation Adjustments for std 11 & 12 |

|

| (a) Goods given for free sample. Adjustments for std 11 & 12 |

|

| (b) Goods given for charity Adjustments for std 11 & 12 |

|

| Goods given for personal use Adjustments for std 11 & 12 |

There is 50 most important Adjustments for Accounts.

With animation entry Presentation Free Demo of presentation download

if you wish please Comments and mail your address.

No comments:

Post a Comment